|

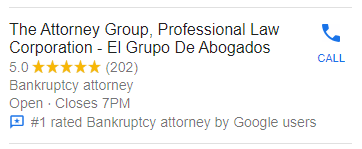

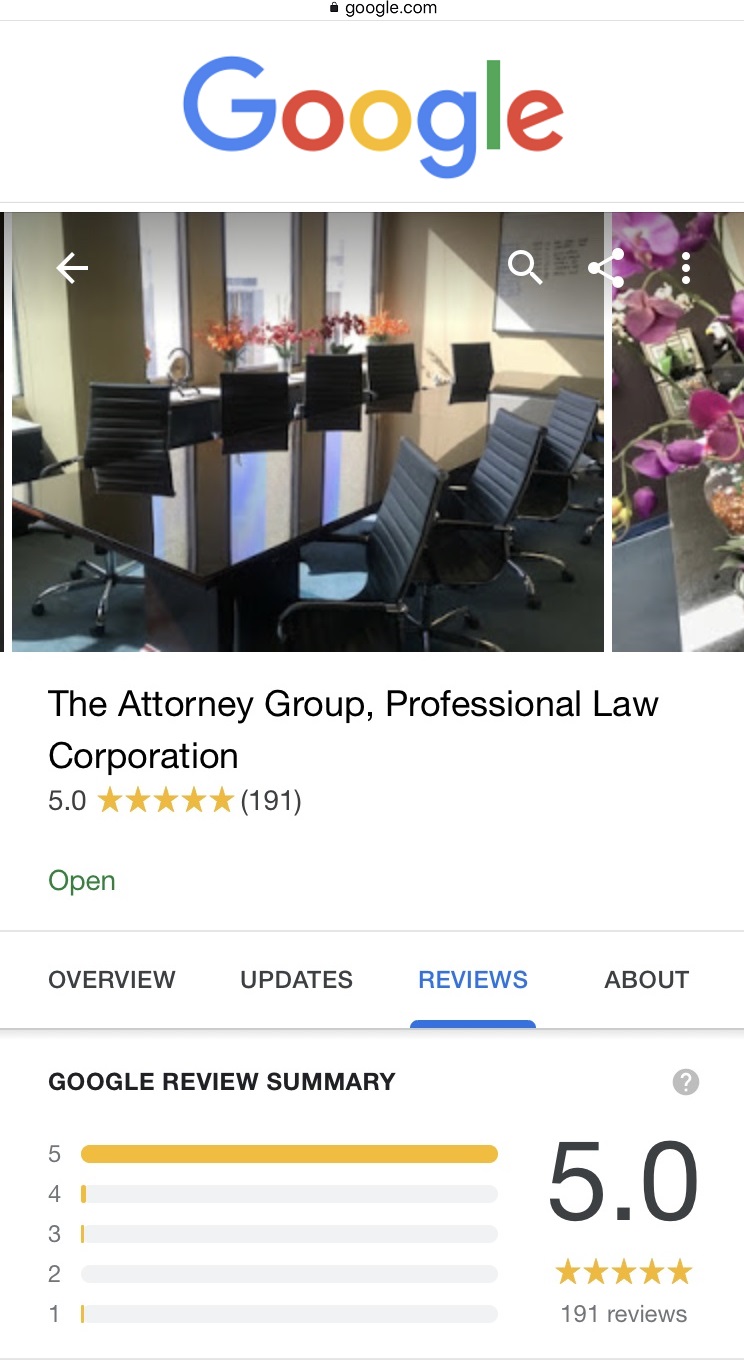

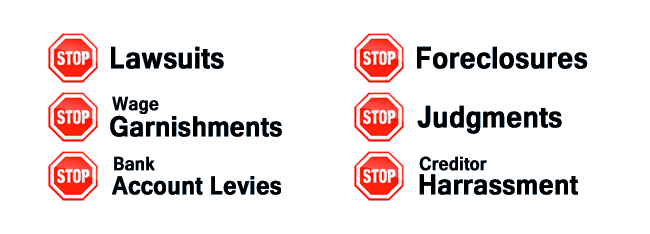

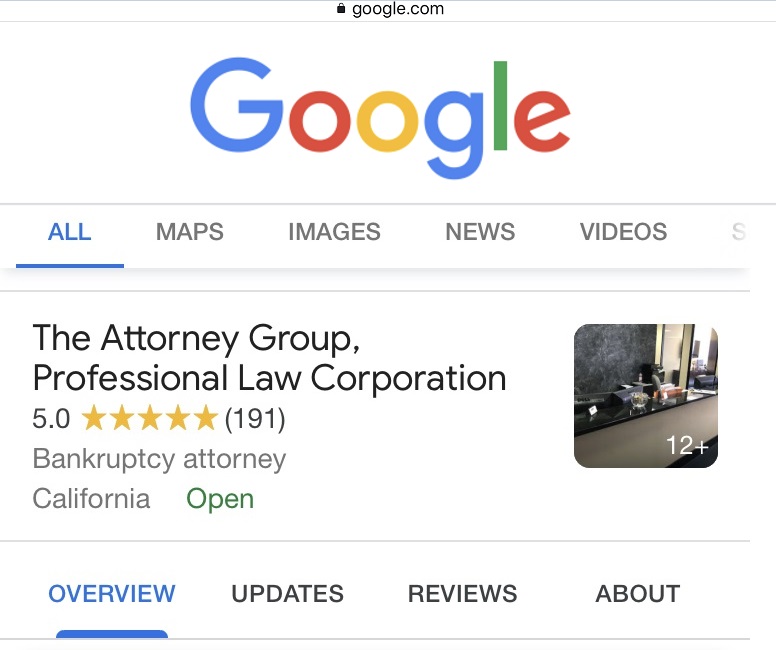

Lompoc Bankruptcy Attorney - Expert Personal and Corporate Bankruptcy Lawyers serving Lompoc, California. If you are struggling financially and looking to speak with a Lompoc bankruptcy attorney, you've come to the right place. We will stop lawsuits, stop garnishments, stop, bank account levies, stop judgments and stop foreclosures. We have 36 locations to meet you in California.

Need immediate assistance? Contact us now!

Toll Free 1(888) 754-9877 Available 7 Days a Week 7am to 9pm 36 LOCATIONS IN CALIFORNIA

A bankruptcy is an opportunity to be relieved of constant harassing phone calls from creditors and collection agencies. Consulting with a bankruptcy attorney to see if a bankruptcy might be your best option, to determine if you qualify for relief and which chapter is appropriate based on your particular circumstances is essential. There are many misconceptions regarding bankruptcy. As a consumer or small business owner, you have the option of Chapter 7 liquidation or Chapter 13 reorganization. Chapter 7 Liquidation Chapter 7 can be utilized by individuals, married couples, businesses and corporations. In most consumer and small business cases, however, you are able to retain most if not all of your personal assets. Also, filing automatically stays or stops all collection activities. You have to qualify for a Chapter 7 proceeding. Your monthly income must be lower than the median income for your state. In California, the median income for a single individual is $47,798 and for two, $62,009. Otherwise, your disposable income must be low enough to qualify. This is determined by deducting your monthly expenses from your average monthly income over the past 6 months. If it is too high, you may still consider a Chapter 13 petition. In any bankruptcy, you must list all your creditors. You must also have not transferred any substantial property within 90 days of filing or within one year if such transfer was made to a relative or business partner or the court can void it. A list of your monthly expenses and assets is also required. You are entitled to certain exemptions regarding your personal assets so that the trustee will not seize them for the benefit of your creditors. For example, you can exempt a motor vehicle, much if not all of your home equity, retirement accounts, bank accounts, furniture, tools of your trade and other items. Consult with our expert bankruptcy lawyer about what exemptions are available to you. You must also take an approved credit counseling class before filing and a personal financial management class before your discharge. Most discharges occur about 4 months after you file. Your unsecured creditors, such as credit cards and medical expenses, are dischargeable. Chapter 13 Reorganization If your disposable income is too high, or if you wish to continue operating your small business, or you face foreclosure of your home, then a Chapter 13 is an option. You must have a steady income, though, to some degree, are paid within either a 3 or 5 year plan. The length of your repayment plan depends on your income. If it exceeds the state’s median, your plan will likely be 5 years. A chapter 13 can save your home from foreclosure provided you can make your regular monthly mortgage payments while repaying your arrearages over the life of the plan. Any second mortgage would be discharged at the termination of the plan if all is otherwise successful. Further, you can have past due taxes, student loans and child support payments paid off within the plan as well. Bankruptcy protection might be the relief you are seeking. Consult with an experienced bankruptcy attorney about your particular circumstances and to see if filing for bankruptcy is the right decision for you. |

Keep Your CAR

Keep Your HOUSE

Keep Your DIGNITY

Keep Your RETIREMENT

Keep Your 401K

Keep Your PENSION

20

Years Experience

9,800+

Happy Clients

Daniel J King, Esq.

Managing Attorney / Owner

Many Locations

LA, OC, Inland Empire

AFFORDABLE

EASY Payment Plans

Phone Meetings

Start your case by phone Attorney meetings by phone

Phone or Zoom

Go to court by phone or zoom

$100+ Million

Discharged

Bankruptcy May Help You:

Free Consultation$100,000,000+ $100 Million Discharged

Bankruptcy May Help You:

Keep Your CAR

Keep Your HOUSE

Keep Your DIGNITY

Keep Your RETIREMENT

Keep Your 401K

Keep Your PENSION

|

|

Free Consultation

100% Free Consultation

(Today)

Process Petition

Become a client

Run Credit Report

Process Petition

Review/Amend Petition

Attorney Meeting

Review Petition

Confirm Petition

Prepare for BK Court

Freedom

341a Meeting of Creditors

(Bankruptcy Court)

with Bankruptcy Attorney

Attorney Daniel J King

Education: UC Berkeley UndergraduateSouthwestern University School of Law

$100,000,000+

$100 Million Discharged

| 20 | 9,800+ |

| Years Experience | Happy Clients |

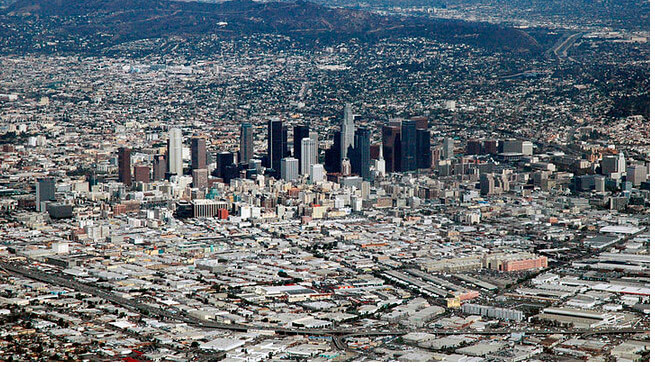

About Lompoc

Lompoc is a city in Santa Barbara County, California, United States. The city was incorporated on August 13, 1888. The population was 42,434 at the 2010 census, up from 41,103 at the 2000 census.

Prior to the European settlements, the area around Lompoc was inhabited by the Chumash. The name of the city is derived from a Chumash word "Lum Poc" that means "stagnant waters" or "lagoon." The Spanish called it "lumpoco." In 1837, the Mexican government granted the land around Lompoc as the Rancho Lompoc land grant. After the United States gained control of California in the Mexican-American War, the valley was acquired by Thomas Dibblee, Albert Dibblee and William Welles Hollister, the latter of whom sold his portion to the Lompoc Valley Land Company. It is from that portion that the present-day Lompoc was established as a temperance colony. The town was originally intended to be called New Vineland, modeled after the temperance colony in New Jersey. Lompoc then became a military town with the completion of nearby Vandenberg Air Force Base. The city is known as the flower seed capital of the world.

Prior to the Spanish conquest, the area around Lompoc was inhabited by the Chumash tribe. Mission La Purísima Concepción was established in 1787, near what is now the Southern edge of the city of Lompoc. During the mission period, the Chumash spoke the Purisimeño language. After an earthquake destroyed the mission in 1812, it was relocated to its present location 1 mile (1.6 km) northeast of the present city. In 1821, Mexico became independent from Spain, and subsequently secularized the California missions in 1833. Mission La Purísima gradually fell into ruins.

In 1837, the Mexican government granted the land around Lompoc as the Rancho Lompoc land grant. The United States gained control of California in the Mexican-American War, 1846-1848. The valley was acquired by Thomas Dibblee, Albert Dibblee and William Welles Hollister, the latter of whom sold his portion in 1874 to the Lompoc Valley Land Company. It is from that portion that the present-day Lompoc was established as a temperance colony. The city was incorporated on August 13, 1888 and the town was originally intended to be New Vineland, modeled after the temperance colony in New Jersey.

Need Help? Call: 1-888-754-9877

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information on this website is not intended to create, and receipt or viewing of this information does not constitute, an attorney-client relationship.

LOCATION DISCLAIMER: The Attorney Group has a main office in Anaheim Hills, California. All other addresses are local offices available on an advanced appointment basis for meetings and depositions.