|

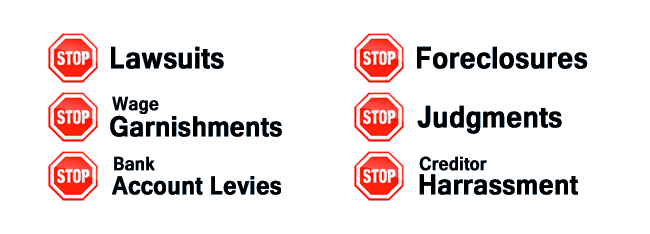

Canyon Lake Bankruptcy Attorney - Expert Personal and Corporate Bankruptcy Lawyers serving Canyon Lake, California. If you are struggling financially and looking to speak with a Canyon Lake bankruptcy attorney, you've come to the right place. We will stop lawsuits, stop garnishments, stop, bank account levies, stop judgments and stop foreclosures. We have 36 locations to meet you in California.

Need immediate assistance? Contact us now!

Toll Free 1(888) 754-9877 Available 7 Days a Week 7am to 9pm 36 LOCATIONS IN CALIFORNIA

A bankruptcy is an opportunity to be relieved of constant harassing phone calls from creditors and collection agencies. Consulting with a bankruptcy attorney to see if a bankruptcy might be your best option, to determine if you qualify for relief and which chapter is appropriate based on your particular circumstances is essential. There are many misconceptions regarding bankruptcy. As a consumer or small business owner, you have the option of Chapter 7 liquidation or Chapter 13 reorganization. Chapter 7 Liquidation Chapter 7 can be utilized by individuals, married couples, businesses and corporations. In most consumer and small business cases, however, you are able to retain most if not all of your personal assets. Also, filing automatically stays or stops all collection activities. You have to qualify for a Chapter 7 proceeding. Your monthly income must be lower than the median income for your state. In California, the median income for a single individual is $47,798 and for two, $62,009. Otherwise, your disposable income must be low enough to qualify. This is determined by deducting your monthly expenses from your average monthly income over the past 6 months. If it is too high, you may still consider a Chapter 13 petition. In any bankruptcy, you must list all your creditors. You must also have not transferred any substantial property within 90 days of filing or within one year if such transfer was made to a relative or business partner or the court can void it. A list of your monthly expenses and assets is also required. You are entitled to certain exemptions regarding your personal assets so that the trustee will not seize them for the benefit of your creditors. For example, you can exempt a motor vehicle, much if not all of your home equity, retirement accounts, bank accounts, furniture, tools of your trade and other items. Consult with our expert bankruptcy lawyer about what exemptions are available to you. You must also take an approved credit counseling class before filing and a personal financial management class before your discharge. Most discharges occur about 4 months after you file. Your unsecured creditors, such as credit cards and medical expenses, are dischargeable. Chapter 13 Reorganization If your disposable income is too high, or if you wish to continue operating your small business, or you face foreclosure of your home, then a Chapter 13 is an option. You must have a steady income, though, to some degree, are paid within either a 3 or 5 year plan. The length of your repayment plan depends on your income. If it exceeds the state’s median, your plan will likely be 5 years. A chapter 13 can save your home from foreclosure provided you can make your regular monthly mortgage payments while repaying your arrearages over the life of the plan. Any second mortgage would be discharged at the termination of the plan if all is otherwise successful. Further, you can have past due taxes, student loans and child support payments paid off within the plan as well. Bankruptcy protection might be the relief you are seeking. Consult with an experienced bankruptcy attorney about your particular circumstances and to see if filing for bankruptcy is the right decision for you. |

Keep Your CAR

Keep Your HOUSE

Keep Your DIGNITY

Keep Your RETIREMENT

Keep Your 401K

Keep Your PENSION

20

Years Experience

9,800+

Happy Clients

Daniel J King, Esq.

Managing Attorney / Owner

Many Locations

LA, OC, Inland Empire

AFFORDABLE

EASY Payment Plans

Phone Meetings

Start your case by phone Attorney meetings by phone

Phone or Zoom

Go to court by phone or zoom

$100+ Million

Discharged

Bankruptcy May Help You:

Free Consultation$100,000,000+ $100 Million Discharged

Bankruptcy May Help You:

Keep Your CAR

Keep Your HOUSE

Keep Your DIGNITY

Keep Your RETIREMENT

Keep Your 401K

Keep Your PENSION

|

|

Free Consultation

100% Free Consultation

(Today)

Process Petition

Become a client

Run Credit Report

Process Petition

Review/Amend Petition

Attorney Meeting

Review Petition

Confirm Petition

Prepare for BK Court

Freedom

341a Meeting of Creditors

(Bankruptcy Court)

with Bankruptcy Attorney

Attorney Daniel J King

Education: UC Berkeley UndergraduateSouthwestern University School of Law

$100,000,000+

$100 Million Discharged

| 20 | 9,800+ |

| Years Experience | Happy Clients |

About Canyon Lake

Canyon Lake is an affluent gated community in Riverside County, California, United States. One of only five gated cities in California, Canyon Lake began as a master-planned community developed by Corona Land Company in 1968. The “City of Canyon Lake” was incorporated on December 1, 1990. It geographically spans 4.7 square miles (12 km2). The Lake was originally formed in 1927 after Railroad Canyon Dam was built. The lake covers 383 acres (1.55 km2) and has 14.9 miles (24.0 km) of shoreline. The population was 10,561 at the 2010 census.

The community of Canyon Lake consists of 2,017 acres (816 ha). According to the United States Census Bureau, the city has a total area of 4.7 square miles (12 km2), of which, 3.9 square miles (10 km2) of it is land and 0.7 square miles (1.8 km2) of it (15.92%) is water. The lake has 14.9 miles (24.0 km) of shoreline.

The 2010 United States Census reported that Canyon Lake had a population of 10,561. The population density was 2,260.8 people per square mile (872.9/km²). The racial makeup of Canyon Lake was 9,495 (89.9%) White, 128 (1.2%) African American, 61 (0.6%) Native American, 190 (1.8%) Asian, 36 (0.3%) Pacific Islander, 316 (3.0%) from other races, and 335 (3.2%) from two or more races. Hispanic or Latino of any race were 1,303 persons (12.3%).

In 1882 the California Southern Railroad built a line from Perris to Elsinore along the east side of the San Jacinto River. The Santa Fe Railroad bought the line and joined it with their line in San Bernardino. Floods in 1884, 1916, and 1927 washed out the tracks and the Santa Fe Railroad decided to abandon the line. Soon after the last flood the Temescal Water Company bought the railroad right-of-way, as well as 1,000 acres (4.0 km2) from Henry Evans, a rancher, and other land from B.T. Kuert. Those were the two parcels that make up most of Canyon Lake today. Construction started in 1927 to build a dam across the river to store water. It was finished in 1929. Railroad Canyon Reservoir, when built, was one of the largest fresh water lakes for fishing, hunting and camping in Southern California. The reservoir and the surrounding area was leased as a concession from Temescal Water Company as a recreational area under the operation of the George D. Evans family from 1937 until after World War II. After the war Ray and Alpha Schekel, along with John and Darleen Kirkland, operated the resort until 1949 when the lake was drained for repairs to the floodgates. Elinor and Donald Martin operated the resort from its reopening in 1953 until 1968. In 1968 the Corona Land Development Company developed the new community.

Need Help? Call: 1-888-754-9877

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information on this website is not intended to create, and receipt or viewing of this information does not constitute, an attorney-client relationship.

LOCATION DISCLAIMER: The Attorney Group has a main office in Anaheim Hills, California. All other addresses are local offices available on an advanced appointment basis for meetings and depositions.